You’re here: Shop / Cardio / Exercise Bikes

Gym Gear Tornado Air Bike - Black

0% Interest free credit - Spread your payments over 6, 9, 12 & 24 months

Commercial leasing - Find out more

Commercial leasing - Find out more

Free shipping

Free shipping

Price match guarantee

Price match guarantee

Description

Gym Gear, established in 2004, combines high performance fitness equipment with advanced technology at affordable prices. The company is held in high esteem, throughout the UK and Ireland, by the numerous commercial facilities it has supplied and installed equipment for. The Gym Gear ethos is based on knowledge, experience and support. You can be sure that, when selecting Gym Gear products, reliability and durability come as standard.

Gym Gear provides unrivalled comfort and versatility in its perform Series machines. The extensive range of ergonomic treadmills, cycles and rowers keeps the athlete engaged, connected and in control with the most user-friendly equipment. Gym Gear’s cardiovascular Performance line has superb asset and body management features, along with stunning, Virtual Go interactive software. Gym Gear is revolutionising the approach to studio fitness, offering the most entertaining and exhilarating workout experiences at impressive affordability.

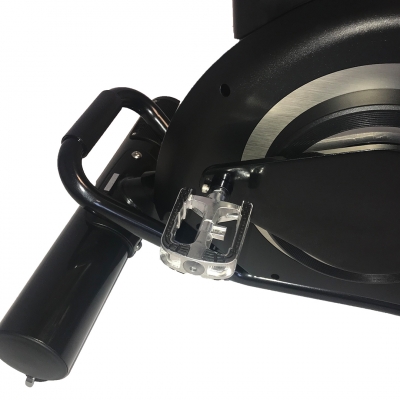

Designed to deliver over 20% more resistance than the competition, the Gym Gear Tornado Airbike's's full commercial rating makes it a must-have for any commercial gym. The Tornado combines heavy-duty steel, precision engineering, and convenient customisation to forge a stronger, sturdier air bike. Infinite resistance levels and dual-action design for the upper and lower body result in an awesome full-body cardio workout. The greater resistance you want, the faster you have to pedal. The Tornado Airbike is the ultimate calorie-burning sweat machine.

Product features

- Steel constructed frame provides maximum stability

- Smooth, J6 Hutchinson drive belt

- Durable belt-driven fan-resistance ensures a super smooth pedalling motion

- Delivers 20% more resistance than the competition

- Easy-to-read LCD screen (workout programmes: manual, target distance, target calories, target HR, target time and champion competitor program)

- Dual-Action design delivers a full body workout

- Front foot pegs allows user to focus on upper body workout

- Adjustment knob provides easy seat height adjustments

- Over sized seat for maximum comfort

- Transport wheels for swift and easy re-positioning of the bike

Specification

Unit weight: 73kg

Maximum user weight: 160kg

Dimensions: L: 126 x W: 67 x H: 131 cm

Warranty: Full commercial: 5 year frame, 1 year parts, 6 months wearable items and 6 months labour

0% Interest free credit - Spread your payments over 6, 9, 12 & 24 months

Your new home gym is just a few simple clicks away

Whether you’re after a brand new treadmill, a complete home gym or wellness products we’ve got a range of payment options to help you spread the cost. Spend between £280 and £15,000 on any items with us (even discounted items) and you can apply for 0% finance. It only takes minutes and all that is required is a 10% deposit.

0% Interest free credit - Spread your payments over 6, 9, 12 & 24 months, minimum purchase price £280.

Please click on a question below to expand:

How long does it take to apply for?

Our online application form typically takes less than 3 minutes to complete, you can also apply instore or speak to our sales team. Your application is then instantly sent to the finance company and they will typically respond with their decision in around 10 seconds. Some applications may take longer to process. If for any reason we can’t give you an instant decision you will be notified on screen as part of the application process and also by e-mail, with a follow up e-mail as soon as a decision is confirmed.

What are the requirements for finance?

- Must be over the age of 18

- You, or your partner is in permanent paid employment (over 16 hours per week), retired (receiving a pension), in receipt of a disability benefit or self-employed

- Has been resident in the UK for at least 3 years and will continue their residency in the UK

- Has a debit or credit card in their name and registered to their address (you’ll need this to match the address used to complete the identity verification)

- You must have a UK bank account capable of accepting Direct Debits

- Has a Bank or Building Society current account (you’ll need this to complete the direct debit instruction)

Can I cancel my credit agreement if I change my mind?

You have the right under section 66A of the Consumer Credit Act 1974 to withdraw from the agreement without giving any reason before the end of 14 days (beginning with the day after the day on which the agreement is made or, if later, the date on which we will tell you that we have signed the agreement). If you wish to withdraw you must give the finance company notice in writing or by telephone or email. The name of your finance company will be clearly shown on your credit agreement (see contact details below). Please note that if you do give notice of withdrawal, you must repay the full amount of the credit without delay and in any event by no later than 30 days after giving notice of withdrawal. If you want to settle the loan after the 14 day cooling off period, you may do so but you will also have to pay interest accrued from the date the agreement was made until the date you repay it. If you wish to pay by debit card please telephone the finance company. If you wish to pay by cheque please send it by first class post to the finance company. Please allow 10 working days from the day you post the cheque to allow time to process the payment.

V12 Retail Finance Limited

20 Neptune Court

Vanguard Way

Cardiff

CF24 5PJ

Tel: 02920 468912

Email: operations@v12finance.com

Will the finance company perform a credit check?

Yes. A credit check forms part of the automated decision making process and is part of a responsible lending policy.

Do I need a bank account?

Yes. You must have a UK bank account capable of accepting Direct Debits.

Do I need to pay a deposit?

Yes, a minimum 10% deposit is required, if you wish to you can pay up to a maximum deposit of 50%.

How do I repay the loan?

Your monthly repayments are collected by Direct Debit.

Can I pay my agreement off early?

You have the right to repay all or part of the credit early at any time - you should contact V12 Finance for details by phone, e-mail or letter at the following:

V12 Retail Finance Limited

20 Neptune Court

Vanguard Way

Cardiff

CF24 5PJ

Tel: 02920 468912

Email: operations@v12finance.com

How much does the loan cost?

The total cost of the loan is shown clearly on the finance agreement.

Are there any other charges?

If you fail to pay any amount you owe under the Credit Agreement by the date it is due, the finance company may charge you interest on that amount, they may also levy additional fees - details of these can be found in your copy of the credit agreement which is available to you as part of the application process and also supplied to you as part of the welcome pack you will receive following acceptance of finance.

How long before I have to start to repay the loan?

The first payment is typically due 30 days following the date of delivery of your order.

What APR will I be charged?

The APR is shown clearly on the credit summary (in the top right hand corner of the screen) throughout the credit application process. It is also shown clearly on the credit agreement itself. The APR for Interest free credit is 0%.

Will I qualify for finance?

To apply for one of our credit options you must meet the following criteria:

- Over 18 years of age

- A UK resident with at least 3 years continual address history

- Be in full time employment, unless retired, or unemployed with a spouse in full time employment

- Have a UK bank account capable of accepting Direct Debits

- The goods must be delivered to your home address (submitted on your application)

Commercial leasing

Benefits

- Fixed rates for the duration of agreement

- Major tax benefits - each payment Is 100% tax deductible

- The equipment can be earning your next payment from day one

- No need to have bank loans, overdrafts or pay cash

- Fast application turnaround

- Spread the cost of your equipment purchase

- Protect existing lines of credit and preserve cash flow for business growth

Talk to our team

Don't wait - elevateyour fitness space today!